News

-

GRANITE STATE CREDIT UNION’S UNVEILS STATE-OF-THE-ART DRIVE-UP FACILITY

Granite State Credit Union is pleased to announce the opening of a new drive-up at their Manchester location (located at 1415 Elm Street)!

-

Protecting Your Kids from Identity Theft

Learn how to protect your kids from identity theft in this month's Fraud Education article.

-

Fraud Education: Five Ways to Protect Yourself From Online Shopping Scams

Learn tips to protect yourself from online shopping scams in this month's Fraud Education article!

-

Fraud Education: Paying With Mobile Can Be Safer Than Plastic — If You Do It Right

Learn how paying with your smartphone can make your shopping experiences easier and potentially more secure in this month's Fraud Education article!

-

Fraud Education: Safe at Home

Learn all about home title fraud in this month's Fraud Education article!

-

Fraud Education: What is Credit Piggybacking?

Learn how to protect yourself from credit piggybacking in this month's Fraud Education article!

-

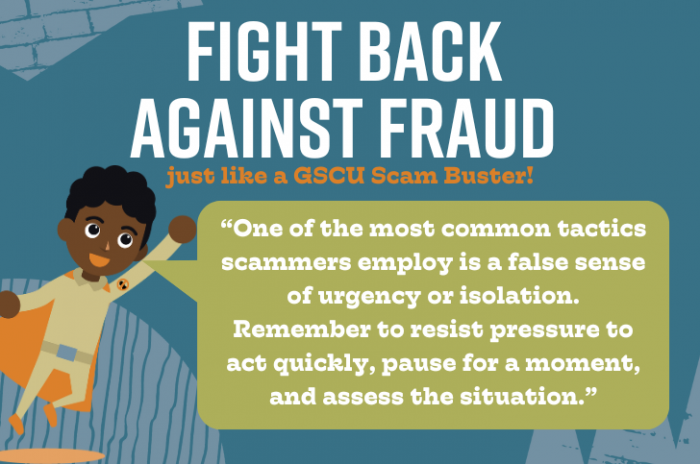

FBI Announces Nationwide 'Take A Beat' Campaign to Increase Awareness of Frauds and Scams

Learn tips to protect yourself, plus how to report fraud to your local FBI office and submit a complaint to the Internet Crime Complaint Center (IC3)!

-

Fraud Alert (8/16/24)

Please be advised that there are two recent reports of fraud pertaining to the following: Electrical Company Scams & Antivirus Scams

-

Fraud Education: How to Protect Yourself From Cyber Attacks

Learn how to protect yourself from cyber attacks in this month's Fraud Education article!

-

Fraud Education: Steps to Protect Your Identity

Learn tips to protect your personal and financial information from theft in this month's Fraud Education article!